TORONTO–(BUSINESS WIRE)–Roxgold Inc. (“Roxgold” or the “Company”) (TSX: ROXG) (OTCQX: ROGFF) is pleased to announce initial results from the newly discovered Gabbro North prospect, further results from step-out and in-fill drilling at the recently discovered Sunbird deposit, and additional high-grade results from depth extension drilling at the high grade Koula deposit, at the Séguéla Gold Project (“Séguéla”) located in Côte d’Ivoire.

Highlights from Reverse Circulation (“RC”) and Diamond tail (“RD”) drilling:

Gabbro North

-

8 metres (“m”) at 39.0 grams per tonne gold (“g/t Au”) in drill hole SGRC1152 from 88m including

- 4m at 76.5 g/t Au from 88m including

- 1m at 163.0 g/t Au from 89m

-

6m at 5.3 g/t Au in drill hole SGRC1154 from 47m including

- 1m at 16.7 g/t Au from 51m

Sunbird

-

12 m at 15.1 g/t Au in drill hole SGRC1290 from 54m including

- 5m at 33.5 g/t Au from 58m

-

9m at 11.7 g/t Au in drill hole SGRC1149 from 111m including

- 2m at 16.5 g/t Au from 112m and

- 1m at 44.6 g/t Au from 116m

- 12m at 4.6 g/t Au in drill hole SGRC1296 from 49m

-

6m at 8.6 g/t Au in drill hole SGRC1300 from 181m including

- 1m at 33.3 g/t Au from 183m

- 23m at 2.4 g/t Au in drill hole SGRC1270 from 75m

-

23m at 2.0 g/t Au in drill hole SGRC1280 from 25m, followed by a separate interval of

- 12m at 3.2 g/t Au from 83m

-

6m at 6.8 g/t Au in drill hole SGRC1297 from 18m, followed by a separate interval of

- 22m at 2.2 g/t Au from 54m

Koula

- 11m at 7.2 g/t Au in drill hole SGDD086 from 279m

-

11m at 5.5 g/t Au in drill hole SGRD1204 from 294m including

- 1m at 18.6g/t from 298m and

- 3m 11.2g/t Au from 300m

- 3m at 6.1 g/t Au in drill hole SGDD084 from 533m

“The drill program at Séguéla continues to build upon the Feasibility Study through the significant exploration prospectivity demonstrated with the discovery of Gabbro North and the extension drilling results at Sunbird. In addition, the results from deeper drilling at Koula emphasise the underground potential with drill defined high-grade mineralization now extending more than 450m down plunge from the base of the DFS pit shell.” commented John Dorward, President and Chief Executive Officer. “The proposed combination with Fortuna Silver will create one of the best organic growth pipelines among any of the intermediate precious metal producers, supported by peer-leading free cash flow generation, increased scale and diversification, increased liquidity and a lower cost of capital.”

Paul Weedon, Vice President Exploration commented “The scout drilling results from the new Gabbro North prospect continues to emphasise the high-grade potential of Séguéla, building off the recent discoveries of the Ancien, Koula and Sunbird deposits. In addition to the success at Gabbro North, drilling at Sunbird identified several high-grade shoots as we move through the infill and extension drilling program, with the deposit still open to the south and down-dip, while detailed logging has identified a potential faulted offset in the north, meaning this area also remains open along strike.

“Further, the encouraging results from the deep drilling at Koula has successfully intersected 11m at 7.2 g/t from 279m in hole SGDD086 and 11m at 5.5 g/t from 294m in SGRD1204. Structural logging of the depth extension holes identified a gradual rotation in the strike direction of the high-grade shoot, resulting in the actual plunge being slightly shallower than originally projected with some drill holes intersecting the margins of the mineralized envelope. In addition, this program is highlighting the development of a parallel high grade hanging wall lode and I am looking forward to results from further step-out drilling as we consider the potential for our first high grade underground resource at the Séguéla Project.”

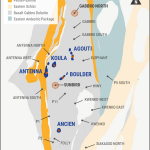

Figure 1. Séguéla deposits and satellite prospects

Gabbro North

Located approximately 7km north-east from Antenna (Figure 1), Gabbro North was discovered through regional geochemistry soil and surface mapping. Interpreted as hosted by sheared basaltic units within the same regional north-south shear zone which hosts the Agouti deposits approximately 3km to the south, mineralization is coincident with the intersection of several north-east trending structures evident in the regional aeromagnetic dataset. A 12-hole scout RC program on 100m line spacing (Figure 2) was completed over two areas where artisanal mining had recently started, testing two prospects and intersecting silica-biotite altered tholeiitic basalts with quartz+pyrite veining and minor felsic intrusives.

Mineralization remains open along strike and down-dip, with drilling intersecting low-grade or narrow intervals in all the other holes. The high-grade intervals have been interpreted as corresponding to a similar setting as the high-grade shoots at Agouti. Further drilling to test to down plunge/down dip extensions as well as several other untested targets is planned.

Figure 2. Gabbro North geology and scout drilling

Highlights from the initial assays returned from Gabbro North include:

-

8 m at 39.0 g/t Au in drill hole SGRC1152 from 88m including

- 4m at 76.5 g/t Au from 88m including

- 1m at 163.0 g/t Au from 89m

-

6m at 5.3 g/t Au in drill hole SGRC1154 from 47m including

- 1m at 16.7 g/t Au from 51m

Sunbird

Located approximately 1.5km southeast of Antenna, Sunbird is interpreted to be hosted by the same north-south striking mylonitic tholeiite/pillow basalt package that hosts Koula and Ancien. A possible link to the Boulder mineralization is also indicated in the regional aeromagnetic dataset highlighting a south-westerly extension and intersection of the north easterly trending Boulder structure with the tholeiitic unit.

Mineralization is hosted by three sub-parallel quartz-carbonate vein sets associated with well developed mylonitic fabric within and along the interpreted margins of a tholeiitic basalt and consistent with the mineralization styles seen at Koula and Ancien. To the north of Sunbird, detailed logging has identified an interpreted steep north-south striking fault which has offset the northern strike projection.

Mineralization remains open at depth (e.g. SGRC1296: 12m at 4.6g/t) and to the south where SGRC1149 intersected 9m at 11.7g/t from 111m the hangingwall lode (assays pending for the main lode after re-entry and extension drilling), and where SGRC1300, the deepest and southernmost hole, intersected 6m at 8.6g/t from 183m (Figure 3) with the high grade mineralization interpreted as having a moderate southerly plunge, similar to Koula and Ancien. Mineralization also remains open along strike to the north with the interpreted north-south fault potentially offsetting the northern strike projection.

Figure 3. Sunbird assay results and assay status (contour of the Central lode shown)

* Note: SGRC1149 represents an intersection in the Hangingwall lode, approximately 15m out of the plane of the image

Highlights from the infill drilling program at Sunbird include:

-

12 m at 15.1 g/t Au in drill hole SGRC1290 from 54m including

- 5m at 33.5 g/t Au from 58m

-

9m at 11.7 g/t Au in drill hole SGRC1149 from 111m including

- 2m at 16.5 g/t Au from 112m and

- 1m at 44.6 g/t Au from 116m

- 12m at 4.6 g/t Au in drill hole SGRC1296 from 49m

-

6m at 8.6 g/t Au in drill hole SGRC1300 from 181m including

- 1m at 33.3 g/t Au from 183m

- 23m at 2.4 g/t Au in drill hole SGRC1270 from 75m

-

23m at 2.0 g/t Au in drill hole SGRC1280 from 25m, followed by a separate interval of

- 12m at 3.2 g/t Au from 83m

-

6m at 6.8 g/t Au in drill hole SGRC1297 from 18m, followed by a separate interval of

- 22m at 2.2 g/t Au from 54m

- 6m at 7.0 g/t Au in drill hole SGRC1286 from 123m

-

5m at 3.5 g/t Au in drill hole SGRC1285 from 16m, followed by a separate interval of

- 9m at 2.2 g/t Au from 90m

Koula

Located approximately 1km to the east of Antenna, Koula was discovered through field reconnaissance and coincident recent artisanal workings in an area previously considered to be a lower exploration priority.

Drilling to test the projected depth extensions more than 450 metres down-plunge from the base of the Feasibility Study pit shell has intersected high grade mineralization in the deepest hole to date with SGDD084 returning 3m at 6.1g/t from 533m downhole. Structural logging has also identified a gradual rotation in the strike direction of the high-grade shoot, resulting in the actual plunge being slightly shallower than originally projected with some drill holes intersecting the lower portion of the mineralized envelope, returning lower grade mineralization. Adjusting for the shallower plunge, drilling has successfully intersected 11m at 7.2g/t from 279m (SGDD086) and 11m at 5.5g/t from 294m (SGRD1204).

With high grade mineralization now extended approximately 450m down plunge from the base of the Feasibility pit shell (refer Company press release March 9, 2021), infill drilling and further down-plunge extension drilling will continue in Q3 to determine the potential for an underground mining project at Koula.

Figure 4. Koula assay results and assay status (contour of the westernmost vein set shown)

Highlights from Koula include:

- 11m at 7.2 g/t Au in drill hole SGDD086 from 279m

-

11m at 5.5 g/t Au in drill hole SGRD1204 from 294m including

- 1m at 18.6 g/t from 298m and

- 3m 11.2 g/t Au from 300m

- 3m at 6.1 g/t Au in drill hole SGDD084 from 533m

Click here to view the full listing of drill results from the recent drilling programs at the Séguéla Gold Project. Note: all results are reported as down-hole intervals which represent approximately 65% of true width.

Quality Assurance/Quality Control

All drilling data completed by Roxgold utilized the following procedures and methodologies. All drilling was carried out under the supervision of Roxgold personnel.

RC drilling used a 5.25 inch face sampling pneumatic hammer with samples collected into 60 litre plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Aircore (“AC”) drilling was collected in one metre intervals and sampled in a similar fashion to RC methods. Once collected, RC and AC samples were riffle split through a three-tier splitter to yield a 12.5% representative sample for submission to the analytical laboratory. The residual 87.5% sample were stored at the drill site until assay results were received and validated. Coarse reject samples for all mineralized samples corresponding to significant intervals are retained and stored on-site at the Company controlled core yard.

DD drill holes were drilled with HQ sized diamond drill bits. The core was logged, marked up for sampling using standard lengths of one metre. Samples were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the Company core yard at Séguéla. The other half was sampled, catalogued and placed into sealed bags and securely stored at the site until shipment.

All Séguéla RC, AC and DD core samples were shipped to ALS Laboratories preparation laboratory in Yamoussoukro for preparation. Samples were dried and crushed by the Lab and a 250-gram split prepared from the coarse crushed material, prior to pulverization and preparation of a 200g sample. Samples are then shipped via commercial courier to ALS’s analytical facility in Ouagadougou, Burkina Faso where routine gold analysis using a 50-gram charge and fire assay with an atomic absorption finish was completed. Quality control procedures included the systematic insertion of blanks, duplicates and sample standards into the sample stream. In addition, the Lab inserted its own quality control samples.

For more information on the Company’s QA/QC and sampling procedures, please refer to the Company’s Annual Information Form for the year ended December 31, 2019, available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

Qualified Person

Paul Weedon, MAIG, Vice-President, Exploration for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has reviewed and approved the scientific and technical disclosure contained in this news release, including the QA/QC, sampling, analytical and test data underlying this information. Mr. Weedon verified the information in the news release by reviewing the drill logs, geological interpretations and supporting analytical data. No limitations were imposed on Mr. Weedon’s verification process.

Roxgold’s disclosure of Mineral Reserve and Mineral Resource information is governed by NI 43-101 and under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time by the CIM. There can be no assurance that those portions of Mineral Resources that are not Mineral Reserves will ultimately be converted into Mineral Reserves.

For more information on the Séguéla Gold Project please refer to Company’s technical report entitled “NI 43-101 Technical Report, Séguéla Project, Feasibility Study, Worodougou Region, Côte d’Ivoire” dated May 26, 2021, available on the Company’s website at www.roxgold.com and SEDAR at www.sedar.com.

About Roxgold

Roxgold is a Canadian-based gold mining company with assets located in West Africa. The Company owns and operates the high-grade Yaramoko Gold Mine located on the Houndé greenstone belt in Burkina Faso and is advancing the development and exploration of the Séguéla Gold Project located in Côte d’Ivoire. Roxgold trades on the TSX under the symbol ROXG and as ROGFF on OTCQX.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities laws (“forward-looking statements”). Such forward-looking statements include, without limitation: economic statements related to the PEA, such as future projected production, capital costs and operating costs, statements with respect to Mineral Reserves and Mineral Resource estimates, recovery rates, timing of future studies including the feasibility study, environmental assessments and development plans. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management’s expectations. In certain cases, forward-looking information may be identified by such terms as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “shall”, “will”, or “would”. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the PEA, the estimation of Mineral Resources and Mineral Reserves, the realization of resource estimates and reserve estimates, any potential upgrades of existing resource estimates, gold metal prices, the timing and amount of future exploration and development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs, the availability of necessary financing and materials to continue to explore and develop the Company’s properties in the short and long-term, the progress of exploration and development activities, the receipt of necessary regulatory approvals, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include: delays resulting from the COVID-19 pandemic, changes in market conditions, unsuccessful exploration results, possibility of project cost overruns or unanticipated costs and expenses, changes in the costs and timing of the development of new deposits, inaccurate reserve and resource estimates, changes in the price of gold, unanticipated changes in key management personnel and general economic conditions. Mining exploration and development is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements, including the factors included in the Company’s annual information form for the year ended December 31, 2019. These and other factors should be considered carefully and readers should not place undue reliance on the Company’s forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

Contacts

For more information:

Roxgold Inc.

Graeme Jennings, CFA

Vice President, Investor Relations

416-203-6401

gjennings@roxgold.com